Questions to ask BEFORE offering on a home in the Greater Burlington, Vermont Area.

If you’re in the market to buy a house in Burlington, there’s a lot of due diligence that you and your MHG Agent will have to do. Here’s a list of 10 important questions to ask before making an offer:

1. Have there been any water issues in the basement? With wild weather swings, some years haven’t been kind to home owners. Given some of the basement flooding that has happened, most Sellers should know if they have a wet basement. Find out if there have been any issues and what (if anything) the Sellers did to waterproof the house.

2. Is there any knob and tube wiring in the house? Much of Burlington's housing stock is older, (vintage? classic?) and many houses still have knob and tube wiring. Knob and tube wiring is often hard to find and given a house may have changed several times in the last few years, the Sellers themselves may not know they have knob and tube – but it’s an important question to ask.

3. Can I get copies of the water and gas bills? It’s important to know how much your utility bills are going to be, and there’s no better way than asking the Seller for their bills. Unusually high or low bills are a good indicator of the energy efficiency of the home.

4. Have there been issues with any of the neighbors? Here’s where you have to hope for some honesty (smart Sellers would disclose any ongoing issues).

5. Were the renovations completed with permits? Are copies of those permits available? If you’re buying a home that’s been renovated, this is an important questions – a lot of renovations require permits (and thus get inspected), but it doesn’t always mean that the home owners got the permits. We often run into renovations that should have had permits and didn’t, so each house has to be evaluated separately.

6. Is anything in the house rented? In Burlington, it’s pretty common for hot water tanks to be rented and it’s important to know all the costs you’ll be taking over.

7. Is there any history of pests? Always a good question to ask. It’s safe to assume that most houses may have issues with squirrels, raccoons, mice, or other pests.

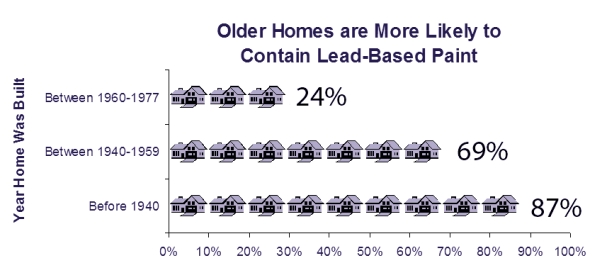

8. Are the pipes lead? Has the supply line from the city been changed? Understanding not only your water cost, but also any potential water issues can be important. City water will have available public information about water quality. If it is a private well, has it been tested?

9. Is there anything else about the house we should know? Sellers have a duty to disclose anything that could materially affect the buyer’s enjoyment of the house. This is always an important question to ask.

10. Disclosure, disclosure disclosure! Have the sellers filled out a Property Information Report? Ask to see it before any offer!

There are more, but we will be there, helping with due diligence, every step of the way.

Expect More.